Copyright 2012: Pension Planners, LLC. Pension Planners. All rights reserved.

4168 Douglas Blvd., Ste. 300 Granite Bay, CA 95746 916-791-9095

Qualified Retirement Plan

Today, the American dream is to have the ability to set aside funds to plan for retirement and unforeseen emergencies. However, in today's ever changing market, finding the extra money to save for the future may seem impossible. At Pension Planners, we are here to help tailor your retirement plan to fit your needs, whether you need to establish a retirement plan for a small business or an individual.

A qualified retirement plan is the solution for planning for the future. A few key benefits of the qualified retirement plan are:

- Provides many tax advantages.

- Names you the Trustee of your retirement account and puts you in control of your financial future.

- Allows for a variety of investment options not available in many other retirement plans.

- Contributions grow tax-deferred until withdrawn.

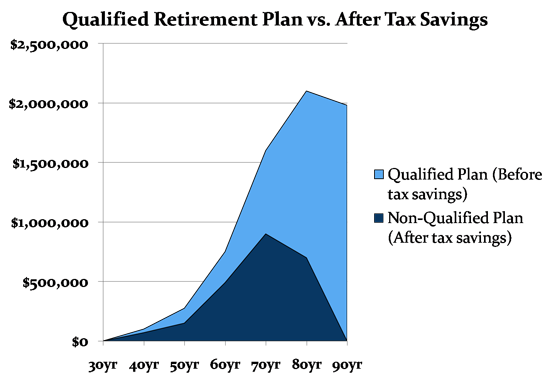

One of the biggest tax advantage offered is the ability to invest your money before taxes. The chart below shows the difference in investing your money before taxes versus investing after taxes.

Not only will a qualified retirement plan provide many tax advantages that can save your business money, but it will also create a positive benefit that will help attract and retain better employees, thereby reducing turnover and training costs. Dramatic law changes in recent years, including those introduced by the Pension Protection Act of 2006, permit greater retirement savings opportunities than ever before. Increasing numbers of small business owners have begun investing into qualified retirement plans and therefore maximizing their investments.

Which qualified retirement plan will meet the needs of your retirement strategy and maximize your investments?

Before we answer this question, let's discuss the different types of plans and their advantages and disadvantages.

There are two types of qualified retirement plans defined benefit plans and defined contribution plans.

Defined Benefit Plan

What is a Defined Benefit Pension Plan (DB)?

A Defined Benefit Pension Plan (DB) is a qualified retirement plan where contributions at the plan are based on a participant's age and compensation. While eligibility and distribution options are the same as other qualified plans, an actuary calculates how much a company must contribute to meet the benefit defined in the plan documents.

How does a Defined Benefit Pension Plan work?

A DB plan provides a specific benefit at a participant's retirement age. The plan's actuary determines the value of the benefit in the form of a single sum. The DB plan must accumulate the funds to provide that benefits by the time the participant has less time until retirement and therefore less time for the plan to accumulate the funds required to provide his/her retirement benefits. Accordingly, the contribution on behalf of the older participant must be relatively high compared to those required for a younger participant.

Defined benefit plans predict what an employee will receive in benefits upon retirement. The predicted benefit amount is based on a variety of factors such as the employee's compensation, age, anticipated age of retirement, and the estimated amount of what the plan can earn over the years. Within IRS limits, the employer determines the method used to calculate the benefit amount. There are two types of formulas for the employer to choose from:

- Unit Benefit Formula

- Flat or Fixed Benefit Formula

An actuary determines the amount that an employer must contribute each year in order to be sure that funds will be there when the employee retires. The employer takes a deduction for the actuarially determined contribution.

Target Benefit

The Target Benefit plan is a type of defined benefit plan that is established to provide a specific benefit (the target) at retirement. Contributions are determined in the first year by information that predicts the rate at which plan investments will grow. After the first year, the contribution formula is fixed and the plan is then shooting to meet the target benefit amount. If investments do poorly, the target benefit amount will not be met. However if investments do better than expected, the employee will receive the increased amount. The target benefit amount is not guaranteed and the employer is not required to adjust the level of contributions. The employer's maximum contribution amount is 25% of the annual compensation paid to the employee.

ADVANTAGES

The employee's retirement benefit has the potential to exceed the target benefit amount if investments do better than expected.

Defined Contribution Plan

A defined contribution plan is similar to a savings account. The employer contributes to an account for each employee. The contribution is based on a defined formula, such as a percentage of the employee's compensation. The benefits that are ultimately paid to an employee are based on what the contributions actually earn over the years. There are a variety of plans under the umbrella of defined contribution plans. Below lists the top 4 plans which are most beneficial to our purpose:

1. Profit Sharing

Profit Sharing

2. Age-Weighted Profit Sharing

Age-Weighted Profit Sharing

3. 401(k)

401(k)

4. Tax Sheltered Annuity 403(b)

Tax Sheltered Annuity 403(b)

Profit Sharing

A profit sharing plan is the most common type of defined contribution plan. Known for its flexibility, profit sharing plans allow the company to decide if they want to make a contribution in a given year and determine the contribution amount. A contribution is never required, which is beneficial to a company when little or no profit is made. However, the plan has the option to allow the business to make contributions during times when no profit is made. The employer's maximum contribution amount is 25% of the annual compensation paid to the employee.

ADVANTAGES

The main advantage of a profit sharing plan is its flexibility. The employer is able to decide whether or not to make a contribution and determine the contribution amount.

Age-Weighted Profit Sharing

In an age-weighted profit sharing plan, the plan formula takes into consideration the length of time until retirement or the participant's age. As a result, older participants receive a larger contribution as a percentage of compensation. This plan must be individually designed as it is not yet available under the IRS prototype.

ADVANTAGES

An age-weighted profit sharing plan is a great investment strategy for a company that wants to give preferentiality to older, highly paid employees.

401(k)

The 401(k) plan allows employee contributions to be made through salary reduction arrangements that let them fund their retirement plan with pretax dollars. These employee contributions are called elective deferrals. Employers often match a percentage of employee elective deferrals as a way to encourage participation. The employer's maximum contribution amount is 25% of the annual compensation paid to the employee.

A couple key facts regarding 401(k) plans:

- There is a dollar limit to elective deferrals. In 2018, the elective deferral cannot exceed $18,500.

- The catch-up (additional) elective deferral limit for those 50 or older is $6,000.

If you own a business with no employees, can you have a 401(k) plan?

Yes, this type of plan may enable you to maximize contributions because you can make both employee salary reduction contributions (elective deferrals) and employer contributions.

ADVANTAGES

401(k) plans are highly desirable to both employers and employees because it allows them to make pretax contributions, thereby reducing current tax scenarios for both. This plan is also highly attractive to current and prospective employees because of the employer contribution match option.

Tax Sheltered Annuity 403(b)

The tax sheltered annuity 403(b) plan is only available to employees of tax exempt organizations (public charities) and employees of certain educational organizations (public schools). Details of eligibility can be found in IRC section 501(c)(3). The plan allows for both employer contributions and employee elective deferrals.

ADVANTAGES

Frequently, retirement benefits are paid as a monthly annuity for the rest of your life. In some cases, you can opt to have the distribution paid in one lump sum.

Advantages of a Qualified Plan vs. an IRA

Can you borrow from your retirement account?

Qualified Plan

IRA

Yes, permitted up to $50,000 or 1/2 vested account.

Not Allowed

Debt financing on real estate without adverse tax consequences?

Allowed

Not Allowed

Deductible contribution limit for 2018?

$55,000 for 401(k), profit sharing.

Only $5,500

Protection from Creditors?

Yes, ERISA provides protection

No ERISA protection

Ability to purchase life insurance?

YES

Not Allowed

Ability to be your own trustee, write/sign checks, and directly control your plan assets?

YES

Not Allowed

Employee contribution (elective deferrals)

$18,500

Not Allowed

Catch up contributions over age 50

$6,000

$1,000

Are distributions allowed for hardships?

YES

Not Allowed

Stockholder in a Sub Chapter S Corporation

YES

NO

The table below is a valuable resource that shows the retirement plan limits for 2018.

Retirement Plan Limits for 2018

Maximum Contribution Limits

2018

Maximum annual benefit under a defined benefit plan

$220,000

Maximum annual contribution for defined contribution plans

$55,000

Annual Compensation limit used for determining retirement plan contributions

$275,000

Maximum annual contribution to 401(k), 403)b), and 457 plans

$18,500

Catch up contribution for individuals age 50 or over

$6,000

Maximum annual SIMPLE employee deferral

$12,500

SIMPLE catch-up deferral - age 50 or over

$3,000

SEP minimum compensation

$600

Maximum annual IRA contribution

$5,500

Catch up IRA contribution

$1,000

Income of key employee in top-heavy plan

$175,000

Definition of highly compensated employee

$120,000

Social Security wage base (OASDI only; no limit for Medicare)

$128,400

Social Security tax rate (employee)

7.65%

Social Security tax rate (self-employed)

15.3%

Comparison Chart of Allowable Rollover

ROLLOVER TO

IRA

SEP-IRA

SIMPLE IRA

ROTH IRA

457(b)

403(b)

Qualified Plan

Designated Roth Account

Rollover fromÂ

IRA

Rollover fromÂ

SEP-IRA

Rollover from

SIMPLE IRA

Rollover from

Roth IRA

Rollover from

457(b)

Yes,

must include in income

Yes

Yes

No

Yes,

must have separate accounts

Yes

Yes

No

Yes

Yes

Yes

Yes

No

Yes,

must include in income

Yes,

must have separate accounts

No

Yes,

after 2 years. Must include in income

Yes,

after 2 years. Must have separate accounts

Yes,

after 2 years

Yes,

after 2 years

Yes

Yes,

after 2 years

Yes,

after 2 years

No

No

No

No

Yes

No

No

Yes

No

Yes

Yes

No

Yes,

after 12/31/97. Must include in income

Yes

Yes

Yes

No

Rollover from

403(b)

Yes

Yes

No

Yes,

after 12/31/97. Must include in income

Yes,

must have separate accounts

Yes

Yes

No

Rollover from

Qualified Plan

Rollover from

Designated Roth Account

Yes

Yes

No

Yes,

after 12/31/97

Yes,

must have separate accounts

Yes

Yes

No

No

No

No

Yes

No

No

No

Yes,

if a direct trustee to trustee transfer

Inherited IRAs not protected in bankruptcy

By Renee Rodda, J.D.

The Bankruptcy Court has determined that, unlike a debtor's own traditional IRA, an inherited IRA is not an exempt asset of the bankruptcy Code 522 (d) (12).The Court concluded that funds in an inherited IRA are not funds intended for retirement purposes but, instead, are distributed to the beneficiary of the account without regard to age or retirement status.

It is generally believed that IRAs are protected in a bankruptcy proceeding, unless the funds have been used in a prohibited transaction. The decision in this case means that taxpayers with financial difficulties may lose any inherited IRAs in a bankruptcy proceeding.

Excluded Accounts

The bankruptcy estate includes nearly all legal and equitable rights of the debtor, as well as those interests recovered or recoverable through transfer and lien avoidance provisions. However, certain assets are specifically excluded under the Bankruptcy Code and may not be used to pay creditors.

Bankruptcy Code 522(d)(12) excluded retirement funds to the extent that those funds are in a fund or account that is exempt from taxation under IRC 401, 403, 408, 408A, 414, 457, or 501(a).

To determine whether as account is an exempt retirement account, the court must determine that:

- The funds are retirement funds; and

- That the funds are exempt from tax under the specified code sections.

Note: The maximum amount that can be protected in an IRA account during a bankruptcy proceeding is $1 million.

The Inherited Account

Although there is no dispute that the original IRA was a retirement account, which was exempt from taxation, the original owner's death and the distribution of the funds to her daughter transformed the nature of the IRA.Her daughter placed the distributed funds into a new IRA account created in her deceased mother's name from which she, as the beneficiary of the new account, must take distributions prior to retirement. Even assuming that the inherited IRA contains retirement funds, the account established by the beneficiary to receive the distribution of funds from her mother's IRA is not a traditional IRA exempt from taxation under IRC 408(e)(1). Although an inherited IRA is exempt form tax under IRC 402(11), this is not one of the specific codes sections listed in the bankruptcy code.

New Roth Conversion Law

On September 27, 2010, President Obama signed into law the Small Business Jobs Act of 2010. This law contains a provision that allows 401(k) and 403(b) plans to permit participants to convert some or all of their existing pretax amounts into Roth accounts within the existing savings plan. This optional provision applies only if a savings plan allows participants to make Roth contributions. It eliminates the need for employees and spousal beneficiaries to roll non-Roth money out of their retirement plan and into a Roth IRA in order to take advantage of the Roth program.

The following types of plans are permitted to allow the Roth conversion: 401(k) Plans, 403(b) Plans, and beginning in 2011, governmental 457(b) Plans. This provision does not apply to money purchase pension plans, profit sharing plans or defined benefit plans.

Listed below are some important facts about the Roth conversion feature:

- A Roth feature must be offered as part of the plan, in order for Roth conversions to be permitted within the plan.

- This conversation is only available to participants who have a distributable event, that would allow them to withdraw (termination, disability, death, attaining age 59½.

- This conversation applies to amounts treated as eligible rollover distributions; it disqualifies hardships, required minimum distributions and corrective distributions.

Exhibits

Exhibit 1

Self Employed 2018

(Sole Proprietorship)

Age 45

Net Earnings from Self-Employment

$50,000

Calculation of Maximum Deduction

Case 1.You have only a Profit Sharing Plan

$50,000 x .20 =

Case 2. You have a Profit Sharing Plan/401(k) Plan

$10,000

401(k) Contribution (elective deferral)

$17,500

Employer Profit Sharing Contribution of 20%. (.20 x $50,000)

$10,000

TOTAL CONTRIBUTION

$27,500

If age 50 or over

401(k)/Profit Sharing Contributions

$27,500

Plus catch up contribution

$5,500

TOTAL CONTRIBUTION

$33,000

OR

Exhibit 2

PROFIT SHARING PLAN 401(K)

(For plan years beginning in 2018)

401(k) / ROTH

Elective deferral 100% up to $18,500(age 50 - $6,000 catch up) or $24,500 if age 50 or older

401(k) Match

Limit combined with Profit Sharing

Profit Sharing

0-25% of eligible compensatioin

Profit Sharing 401(k) Trust Assets

- Contributions are tax deductible

- Deposits not taxed to employee

- Tax deferred growth

- Protected from creditors

- Loans up to $50,000 are permitted

- Life Insurance Allowed

- Leveraged Real Estate profits not taxable

Exhibit 3

Don't Forget the Small Business Tax Break

- Income tax credit for a small business that adopts a retirement plan

- Offsets qualified start-up costs of up to $1,000/yr

- 50% annual credit for 3 years (maximum $500/yr)

- You are an eligible employer if in the preceding year you have 100 or fewer employees who received at least $5,000 in compensation.

- Must cover at least one non-highly compensated employee

- The employer must not have established or maintained any employer plan during the three tax year period immediately preceding the first tax year in which the new plan is effective.

Qualified Startup Costs

- Any ordinary and necessary expenses paid to 1) begin or administer an eligible employer plan and/or 2) educate employees about the plan.

Eligible Employer Plan

- A plan that meets the requirements of a defined benefit or defined contribution plan including a 401(k) plan, SIMPLE plan or simplified employee pension.

Exhibit 4

Small Business Tax Credit for Qualified Start Up Cost of Retirement Plans

Cost of retirement plan set up

$2,495

IRS Tax Credit for Retirement Plan Set up and Administratioin

($500/yr for 3 years)

<$500>

Net Cost after Credit

$1,995

Deduction Tax Savings

(40% tax bracket)

<$798>

Net after Tax Cost to set up QRP

$1,197

Exhibit 5

Savers Credit

Couples Get up to $2,000 FREE from the U.S. Government.

You are entitled to a tax credit of up to 50% of your contribution to nearly any type of retirement plan.

For individuals with incomes under $55,000, retirement savings contribution credit the tax laws provides up to a $2,000 nonrefundable saver's credit to encourage contributions to certain types of retirement plans, such as 401(k)s and Profit Sharing Plans. The amount of the credit is based upon the total contributions to qualified retirement plans plus elective deferrals. The credit rate can be as low as 10% or as high as 50% (IRS publication 560).

Exhibit 6

ABC Personal Corporation, Inc.

Net Income $80,000

2017 Tax at 40%

$32,000

OBJECTIVE

How to reduce corporation taxes and minimize personal income taxes?

ANSWER

Employer contributes 25% of W-2 to Profit Sharing Plan and employee makes elective deferral to the 401(k) plan

John & Mary Jones - 100% Stockholders

John's current salary

$26,000

Bonus

$25,000

Total Comp

$25,000

$51,000

$51,000

$26,000

Mary's current salary

$52,000

$50,000

$102,000

STEP 1: John and Mary elect to defer the maximum of their bonus to the 401(k) plan by making an elective deferral (both are over 50 years of age) of $22,000 each

Result: $25,000 bonus minus elective deferral of $22,000 = $3,000 taxable on their personal tax return. Reduction in personal income on their Form 1040 of $44,000 ($22,000 x 2)

STEP 2: Corporation contributes the max (25%) of their W-2 wages ($102,000) or $25,500 to the Profit Sharing Plan and Corporation takes a deduction for this amount.

Result: Corporation deducts $25,500 on its tax return and no payroll on income taxes on this amount.

New tax results for corporation and individual are as follows:

CORPORATION

Taxable Income

Less Bonuses

Profit Sharing Contribution

Taxable Income

Taxable rate 40%

$80,000

<$50,000>

<$25,500>

$4,500

.40

$1,800

Reduction in Taxes

$30,200

PERSONAL INCOME TAX RETURN

Personal income increased by $3,000 each

Taxable rate 30%

Tax Increase

$6,000

.30

$1,800

INCOME TAX SUMMARY OF RESULTS

Corporate Tax Decrease

Personal Tax Increase

Net Income Tax Decrease

$30,200

<$1,800>

$28,400

Payroll Tax Decrease on Profit Sharing Contribution

15.31% x 25,500

$3,901

Total Tax Savings

$32,301

Exhibit 7

Safe Harbor 401(k) Plan Features

- Allows all participants to contribute up to maximum annual deferral limit ($18,000), plus catch up ($6,000) contributions for employees age 50 and over.

- Requires a flat contribution of 3% of pay or a 100% match on salary deferrals up to 4% of pay.

- Eliminates the burden of restrictive discrimination testing.

- Allocation of additional profit sharing may be customized to benefit plan sponsors and/or select groups of employees.

- Vesting of required contributions is 100% immediately.

- Allows additional matching and/or profit sharing contributions.

Sample Safe Harbor 401(k) Plan

Total Contribution

Profit Sharing

Salary Deferral

Compensation

Participant

Participant

Participant

Owner

TOTALS

$17,000

Discretionary

$850

$850

$30,000

Discretionary

$1,500

$1,500

$40,000

Discretionary

$2,000

$2,000

$245,000

$22,000

$32,500

$54,500

$332,000

$22,000

$36,850

$58,850

Now that we have covered the basic concepts of qualified retirement plans, let's go back

to the original question. Which qualified retirement plan will meet the needs of your retirement strategy and maximize your investments?

Pension Planners, LLC can help you decide which qualified retirement plan will best suit your financial goals and maximize your investment to its fullest potential. Simply fill out the Information Request Form and we will get back to you promptly with detailed plan information. Let our seasoned team of professionals assist you in planning and implementing a plan to secure your financial future!

Pension Planners, LLC considers the following plan to be an ideal plan for small businesses. The "Ideal Plan" allows owners to contribute the lesser of 100% of compensation or $55,000, provides a 5% contribution for non-owner participants, and has the employee benefit of a 401(k) plan.

Why do we consider this plan to be the "Ideal Plan" for 2018?

- Greater contribution benefits to certain groups of employees.

- Employees have more control over their retirement plan and flexibility regarding their participation.

- No inflexible discrimination testing associated with traditional 401(k) plans.

- A 5% employee contribution can be used to satisfy both the 401(k) and profit sharing discrimination tests.

Exhibit 8

THE IDEAL PLAN - 2018 PLAN YEAR

Owner

Employee 1

Employee 2

Employee 3

TOTALS

Age

Compensation

401(K) EE Deferral Contribution

Profit Sharing Contribution

Total Contribution

48

24

28

32

$245,000

$17,000

$30,000

$40,000

$332,000

$18,500

At Employee's Discretion

At Employee's Discretion

At Employee's Discretion

$36,500

$18,500

$850

$1,500

$2,000

$40,850

$55,000

$850

$1,500

$2,000

$59,350

Pension Planners, LLC

2250 Douglas Blvd. Suite 160

Roseville, CA 95661

Phone: 866-485-7929

4381 W. Flamingo Rd #38307

Las Vegas, NV 89103